Table of Contents

If you’ve never had any formal system for keeping track of your saving and spending (or if you’re tired of tracking every expense on an Excel spreadsheet), there are a plethora of mobile apps to bring you to the top of your financial game. With the gamified nature of these apps, saving money can even be fun. Not sure which apps are worth the download?

Here’s a short list of some of the best apps for saving money and helping you reach your financial goals faster:

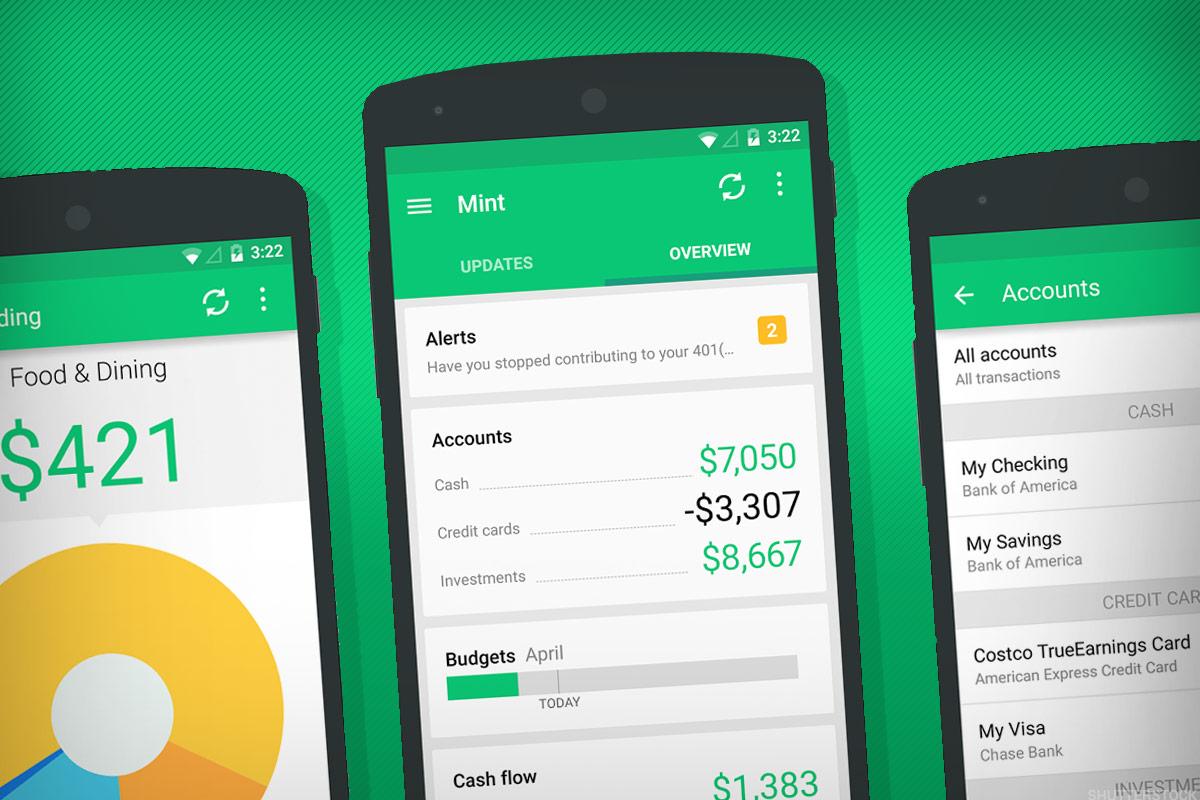

Best App for Budgeting – Mint

Pros:

Since its inception, Mint has been well-regarded as one of the best budgeting and money management apps out there. Unlike many other budgeting apps, which require you to manually enter each purchase and paycheck, Mint integrates with your bank account to track expenses and income automatically. This app is the very definition of “set it and forget it.”

Mint integrates with QuickBooks, your retirement savings, and more to provide a comprehensive overview of your personal finances. The app can also track your bills so that you can avoid incurring any late fees for missed payments.

Perhaps most useful of all, Mint can calculate average spending by category and send notifications from a daily budget tracker with how much you have left to spend. With these useful insights, you can modify your behavior if you find that you are overspending in one area (like restaurants) or not allocating enough to savings. The app interface includes graphs and charts to illustrate your habits and where you can further optimize your finances.

Mint is completely free to use.

Cons:

Unlike some of the other apps on this list, Mint is not connected to a separate bank account. It’s more like your all-in-one financial dashboard. Mint is a great choice if you’re not looking to open any new accounts to set goals, and instead want to find ways to maximize your budgeting skills.

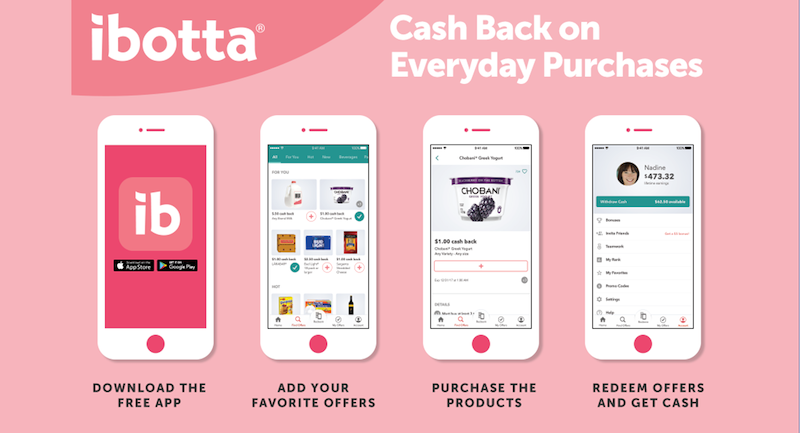

Best App for Saving on Groceries – Ibotta

Pros:

Ibotta enables shoppers to earn cashback at a variety of grocery stores, restaurants, and shops. Ibotta features more than 300 different grocers and retailers, including CVS, Stop & Shop, Shoprite, and ACME.

Each week, Ibotta rotates new offers that you can redeem for cashback. While some cashback deals are tied to specific items or brands (for example, $0.10 cashback on a 20 oz bottle of Diet Coke purchased at CVS), other deals are eligible for any brand (such as $0.25 cashback on any organic milk purchase). After completing your in-store purchase, you can scan your receipt and the item’s barcode to redeem your cashback.

For a limited number of online retailers, you can also earn a flat percentage of cashback on mobile purchases. First, you must log into the retailer’s website from the Ibotta app so that Ibotta knows how much you spent and therefore how much cashback you earned. For example, you can earn 2.5% cashback on purchases from Forever21.com if you log into Ibotta first.

In addition, Ibotta frequently has bonus offers, which enable you to earn even more cashback for completing certain actions, like redeeming 15 offers in one week or spending $20 on a mobile shopping offer through Ibotta. These bonus offers are particularly useful if you’re planning a large trip to the grocery store and can redeem a lot of offers for items you were going to buy anyway.

Ibotta is free to use.

Cons:

Ibotta requires a bit more elbow grease than some other apps. To earn cashback, you either need to take pictures of a paper receipt or launch a participating retailer through the Ibotta app. If you don’t do either of these actions, you will be unable to redeem your cashback rewards.

Furthermore, you need to accrue $20 in cashback through Ibotta in order to access the funds. After reaching the $20 threshold, you can transfer the funds to Venmo, Paypal, or a gift card for a retailer of your choice.

The key to saving money with an app like Ibotta is to only use it when you were already planning on buying the item; don’t spend $30 on items you don’t need just to redeem $3 in bonus cash!

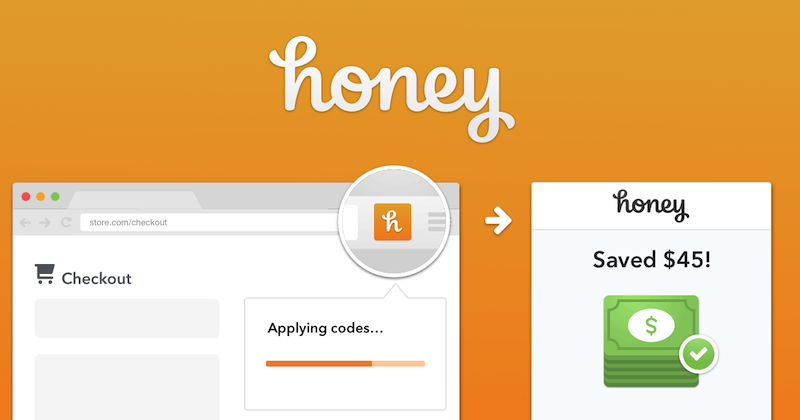

Best App for Saving on Online Shopping – Honey

Pros:

Some of the best money-saving tools are the ones that require the least amount of effort. That’s why Honey is one of the highest recommended discount tools for the modern shopper. Honey is a browser extension that helps you find the best deals and discount codes when shopping online, saving you both money and time.

While you browse for items at an online retailer, Honey works in the background to find every working promo code available and apply the best one to your purchase. That means you don’t need to Google the discounts on your own or get frustrated when a code you found doesn’t work. Instead, Honey can crawl through over 37,000 sites and find your perfect deal. According to Honey’s website, the average discount for users is 17.92%. No additional setup is required after adding the Honey browser extension—just make sure you add it to your preferred browser so you don’t miss out on any deals.

Honey is also free.

Cons:

While Honey technically has an app as well as the browser extension, the app functions as more of an online marketplace where you would buy items within the app, rather than from the retailer’s website itself and have discounts automatically applied. The app also has limited store options and many reviewers say that the search functionality is not great. It might be worth sticking with the browser extension while some of the app’s bugs are fixed.

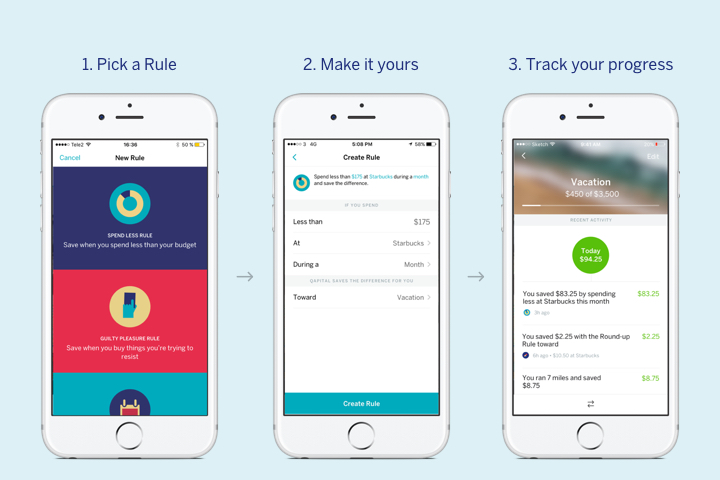

Best App for Achieving Specific Financial Goals – Qapital

Pros:

Trying to save money for your next vacation? Or counting your pennies for a new car? Qapital is there to help you make it happen. This app is designed to help you save a little bit at a time, and transfer those savings to an FDIC-insured account by Wells Fargo. Qapital also enables you to earmark your savings for specific purposes.

Qapital uses a system known as Goals and Rules to “supercharge your saving.” For Goals, you can set multiple financial targets with specific dollar amounts, like saving $1,000 for a new laptop or $2,500 for a cruise. Then sit back and watch how your savings get you closer and closer to that goal. Qapital also uses “Rules” to help you improve your own financial behaviors. Trying to spend less on that morning latte? Set a “Guilty Pleasure Rule” so that every cup purchased at Starbucks triggers the app to transfer $2 to your savings. Use your credit or debit card for everything? Set a “Round Up Rule” that rounds up each purchase to the nearest dollar and places it in the Qapital savings account. You’ll find that small changes add up significantly over time.

With Qapital, you don’t have to go on your savings journey alone. You can create joint goals with other Qapital users, such as saving for a vacation with friends or for a wedding with a partner. The app also launched options for investing if you want to transfer your new savings into an investment account.

Cons:

Qapital offers a lot of bells and whistles, but it comes with a price tag. Qapital offers a tiered membership structure, starting at $3 per month for the basic plan and going up to $12 per month for the master plan. You can also start a 30-day free trial to see if the app matches your financial needs. At the end of the trial period, determine what your goals are for the app before choosing a pricing plan that’s right for you.

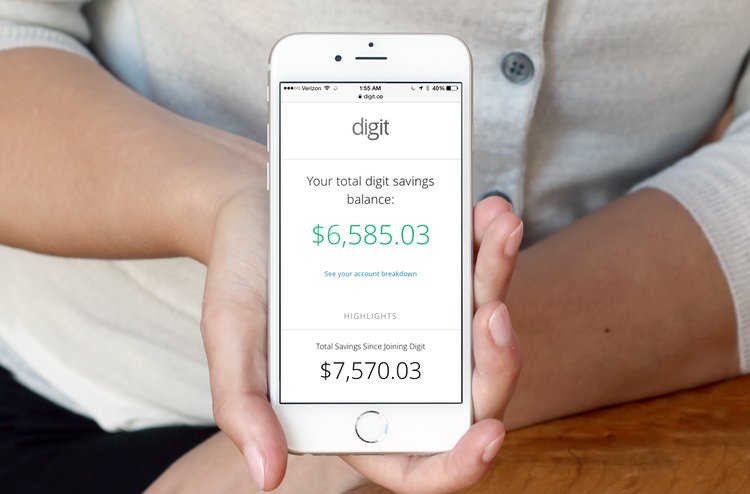

Best App for Automated Savings – Digit

Pros:

If thinking about your savings stresses you out, Digit might be the app for you. Digit connects to your bank accounts to analyze your spending and automatically save the ideal amount every day. The app adapts to your financial habits and saves accordingly, meaning you will not need to figure out an arbitrary amount of money to transfer from checking to savings each month (or risk incurring overdraft fees).

All money saved through Digit is held at FDIC insured banks. If you prefer to transfer any savings through Digit to a different bank account, the app offers unlimited withdrawals and has no account minimum. Like Qapital, you can also use Digit to allocate savings for different goals, like a new vacation or an emergency fund.

An added incentive for using Digit is that the app rewards you for saving. Every three months, you can earn a 1% Savings Bonus.

Cons:

Unlike most of the apps on this list, Digit has a subscription fee of $2.99 per month. However, the first 30 days are free if you want to do a trial run before committing to using the app long-term.

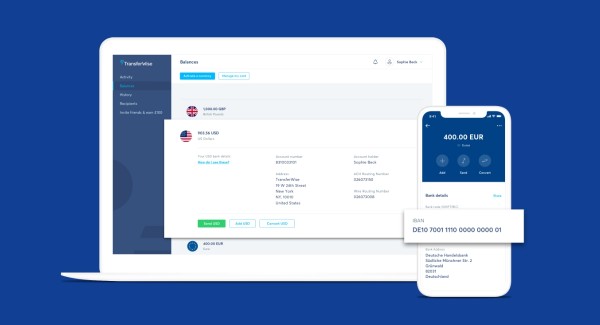

Best App for Saving on International Money Transfers – TransferWise

Pros:

Are you working abroad, or sending money to relatives in another country? Those international transfer fees can add up a lot. And that’s not even accounting for the higher exchange rate that banks charge consumers. Luckily, TransferWise is an app that eliminates international bank fees and transfers money at the mid-market rate, which is the fairest exchange rate. Now you won’t get that nasty shock from realizing that the exchange rate on Google is much better than what the bank gave you.

If you travel frequently, you can also open a borderless bank account that holds up to 40 currencies concurrently. TransferWise recently launched an international debit card, too.

Cons:

TransferWise is not a money-saving app for day-to-day expenses and will not help with daily budgeting. Unless you travel often or need to send money between countries, this app may not be worth it to you.

While the app is free to download, each transfer will incur a small fee based on the amount sent.

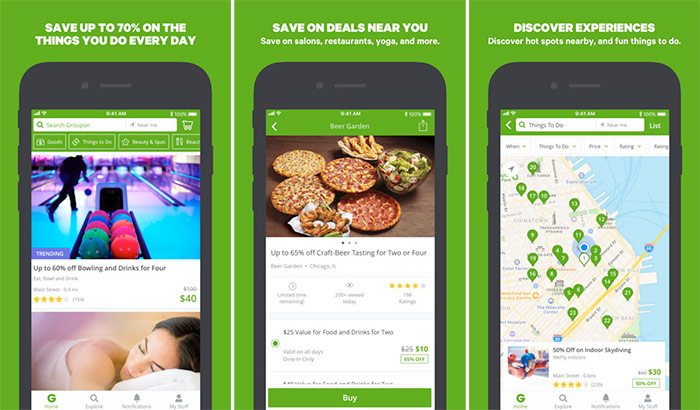

Best App for Saving on Experiences – Groupon

Pros:

Need a new haircut? Or want to try that yoga studio that recently opened in your town? Chances are, there’s a Groupon for that. Groupon is an app and a website to help you find the best local deals on experiences ranging from beauty treatments to classes at fitness studios, to performances at comedy clubs or local theaters.

Discounts through Groupon can be as steep as 50% off or more compared to the original price. While some deals have a specific redemption date, such as tickets for a show, others have a longer window such as 90 days to redeem the offer.

Groupon is best for finding deals at local businesses or organizations, but the app’s benefits extend far beyond your own neighborhood. If you want to book a getaway, Groupon also has a robust selection of tour packages, hotels, and travel deals to make vacation planning easier on your wallet.

Even better, Groupon frequently has additional discounts and sales that you can apply on top of the already discounted rate. You can also launch the Groupon app from Ibotta, giving you even more savings.

Cons:

Usually, Groupon deals are one-and-done. After you redeem your offer with a certain merchant, you can’t redeem the same offer again. So while Groupon deals are great for new things you want to experience once, try not to get too attached to that yoga studio if you’re not willing to pay full price after your Groupon promotional period ends.

Which apps for saving money have you tried before, and which are you most looking forward to testing out? Let us know in the comments below…

You May Also Like: Debtless One Car Living: How To Save Money And Help The Environment