This guide will cover the ins and outs of the Roth IRA. Understanding the Roth IRA can be a little intimidating and complex, so we hope by the end of this you will have a complete grasp on what it is and how to set one up. This guide is meant to be an educational resource for you, so please seek advice from a professional.

Table of Contents

Part 1: What is a Roth IRA?

Intro to Retirement Accounts

Regardless of your experience level in finance, chances are you’ve heard of a “Roth IRA”. One of the most common misconceptions about the Roth IRA is that it is itself an investment. A Roth IRA is simply an account where you can put money, similar to a savings account.

The key difference being that your Roth IRA holds investments, like stocks and bonds, where your savings account holds cash. While there are many types of investment accounts that allow you to hold investments, the Roth IRA has some particularly advantageous features that should not be overlooked. Whether you have been managing your retirement portfolio for 30 years or are brand new to investing, it is critical that you understand the Roth IRA.

When it comes to financial planning, understanding the features of your accounts is just as important as the investments that you put inside them. Investors who fail to fully research how to get money into and out of their accounts run the risk of paying high penalties and missing out on some of the best features these accounts have to offer. Below you will find a comprehensive, in-depth, review of the Roth IRA. We will walk chronologically through the life cycle of the account, from opening to closing to give you a better, understanding of this powerful investment tool.

Qualified and Non-Qualified Accounts

In the universe of investing accounts, there are essentially two categories available to investors; a “Qualified” account which is one that QUALIFIES for special tax treatment from the government and a non-qualified account which does not qualify for this special tax treatment.

While there are some non-qualified retirement plans out there, they are usually reserved for specific employees or executives. Due to the case by case nature of non-qualified accounts, we will not be covering them in this guide.

To set the stage for this discussion of retirement accounts, we must discuss the ERISA act. This distinction between qualified and non-qualified accounts was created in 1974 the government passed the Employee Retirement Income Security Act, or ERISA. The purpose of this act was to create a standard set of rules for employers to follow when drawing up their benefits to offer employees.

While ERISA does not require employers to offer benefits, it simply enacted standards for employers who choose to do so. This is an important piece of legislation as it set up “retirement accounts” as we know them today.

What is an IRA?

What the government did with ERISA in 1974 was acknowledge that saving for retirement is highly important to both individuals and society. Within the act, the government set down specific features and advantages that would be provided to “retirement accounts”. While this was great news for people who had jobs offering benefits, like a 401k, these special tax incentives were not available to Americans who did not currently have a job that provided them with a retirement account. The federal government then created what are known as IRA’s or INDEPENDENT retirement accounts to extend these benefits to everyone in the country.

When the government created this distinction between retirement and non-retirement accounts, they decided to set a few rules, as well as a few benefits to encourage people to put something away for themselves in retirement and leave the money be. Let’s start off by looking at the benefits of retirement accounts, keep in mind that this is an overview and will be elaborated in more depth below.

Among these new “independent retirement accounts”, or IRA’s as they’ll be referred to for the remainder of the guide, the government offered 2 flavors. The “traditional” and the “Roth”. Traditional IRA’s function just like your 401k from work, money is added to the account on a PRE-TAX basis and allowed to accumulate without tax, until funds leave the account in retirement. At that point, you are taxed on the money leaving the account at your income tax rate. Any money that you add to the account must not be withdrawn until you are 59 ½ years old or you risk incurring an additional 10% tax penalty.

One of the other things to keep in mind with the traditional IRA is there are rules that govern how you take distributions. If you still have funds in your traditional IRA at the time you turn 70 ½ years old, the federal government requires you to take what are known as RMD’s or “required minimum distributions” from the account on a schedule until it is depleted. This means, in the year you turn 70, the IRS will perform a calculation to determine a minimum amount that you MUST withdraw from your account, in that year or face a 50% penalty.

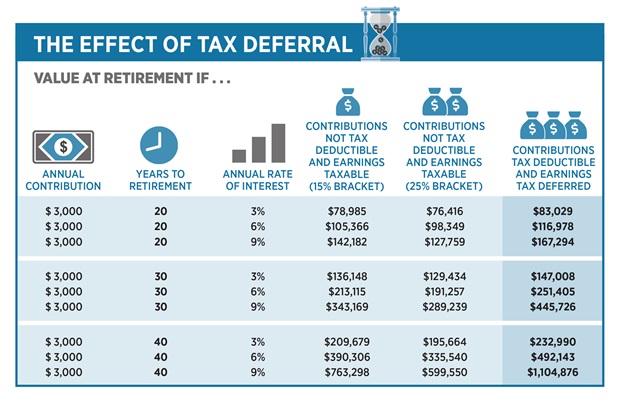

As you are probably aware, one of the key benefits to Traditional IRA’s is something called “tax deferral”. Tax deferral is the process by which the government postpones taxes within your account to allow for faster growth. In order to appreciate how significant the advantage given to these retirement accounts, we need to first look at how normal, non-retirement accounts are taxed.

Understanding Taxes

In a standard investment account, when an investor gains in any way, he or she must pay taxes on those gains. How he or she is taxed depends on what kind of earnings were received. For example, if the investor owns bonds, which earn interest that is paid in the form of income, the investor will pay income tax on the money. If the investor owns stock and sees an increase in the price of his underlying investments, he or she will have to pay capital gains tax whenever the investments are sold.

In order to demonstrate how this would work in a standard brokerage investment account, we will set up a quick example. Let’s say that Joe has some extra savings and wants to become an investor. After working with an investment professional Joe selects several stocks that he would like to purchase. These stocks pay their investors what are called “stock dividends”, meaning that when the investments generate money, rather than sending those earnings out to the investor, the company simply offers the investor more shares of the underlying stock. However, because Joe opened a non-retirement investment account, every time one of these “stock dividends” is issued, the tax must be assessed on the gain.

In practice this works as follows:

- Year 1: Joe invests $1,000

- Year 2: Joe receives a 10% stock dividend ($100 of new stock added to his account) which should bring his account value to $1,100

- Before Joe can collect his full stock dividend, however, he must pay taxes on his earnings. For simplicity, let’s just say he pays 15% or the long-term capital gains rate.

- $15 of his $100 gain will be taken in taxes, and Joe will receive $85 in new stock in his account

- Year 3: Joe receives another 10% stock dividend ($108.50) that is taxed bringing his account value to $1,202.

As you can see from the example, Joe is growing his investment steadily, but each time he sees gains, a small cut is taken off the top in the form of tax. This structure is basically how all non-retirement investment accounts would work, two steps forward and one step backward each year due to taxes.

Now that we understand gains and taxes in normal investment accounts, we can truly appreciate the benefit of investing in a qualified retirement account.

While this is not a guide on traditional IRA’s it is important to understand their features, so you are able to hold it up against the Roth IRA to compare. Both accounts offer the benefit of tax deferral on gains within your account, with one key difference, in a Roth the taxes are not necessarily deferred. Once you have paid income tax on the money you contribute, you are done paying taxes.

If this sounds too good to be true, keep in mind that this account is intended for smaller investors and is designed for growth. It carries no income tax on your withdrawals from the account, allows you to retrieve money from your account without incurring a penalty, and carries no distribution schedule. In short, it is considered by many to be the most beneficial and flexible accounts available today.

Part 2: Opening Your Roth IRA

How to Open an Account

After learning about the amazing features that the Roth IRA has to offer, your probably wondering how to get started. The first step in any Roth IRA’s life cycle begins when the account is opened at a financial institution. You have probably heard about companies like Vanguard or Fidelity, these large financial institutions not only create their own financial products, but they also offer a host of investment-related services, one of these is account creation. You can set up an account in minutes and begin trading immediately. You are not limited to a large wirehouse firm, however.

There are many financial services companies such as Edward Jones, and Charles Schwab where investors can open an IRA. You can even walk down the street to your local bank who may have the ability to open an account for you.

While deciding where to go to open your account it’s important to understand your specific experience level. Investors with more background in finance may be just fine to open an account at fidelity and begin buying investments, while other less-informed investors may want to seek out a financial advisor to help walk them through opening their account and selecting investments. The large wirehouse firms like vanguard and fidelity will have lots of research tools available to you, but they tend to cater to investors who are more self-directed. You can receive certain information pertaining to your account, but you will have little in the way of guidance. For readers who would like a little more direction, many firms exist, both large and small, where advisors and products can be found.

Now that you have opened your account, it’s time to fund it. Funding the account is simply the process of adding cash into the IRA so that it can be invested. Here is the first place where the Roth IRA differs from other qualified plans. While most qualified accounts allow you to invest pretax dollars (money is not taxed as income before being added) Roth IRA’s invest post-tax dollars. This sounds like a negative until you learn that once the money has been taxed and added into your account, it is never taxed again. Your reading that correctly, you will not pay tax on any of the gain that you see in your Roth IRA, as long as you follow the rules.

Funding Your Roth IRA Account

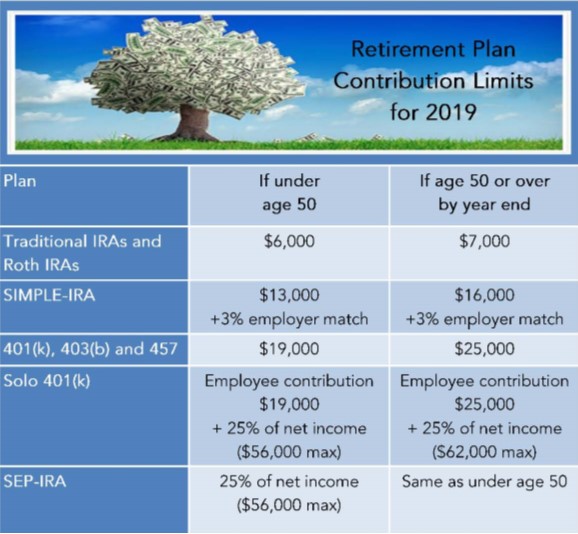

Because these accounts (both Roth and traditional) have such advantageous features, the government limits the amount of money that an investor can put in each year. These limits are the same for both varieties of IRA and work like this: While an investor is young before they turn 50, they can contribute up to $6,000 each tax year to their IRA accounts. Note that an investor cannot contribute $6,000 to a traditional and $6,000 to a Roth. It is perfectly legal to own both accounts and contribute your total contribution to both accounts, you cannot exceed you given $6,000 limit.

Once an individual reaches age 50 the rules change slightly. Because people in this age range are closing in on retirement, the government allows them to increase their contributions to these accounts. From age 50 onwards an individual can add $1,000 in what are referred to as “catch up” contributions to these accounts. These additional contributions bring the total you could add to IRA’s after 50 to $7,000 annually.

Conversions and Contributions

There is only one way an investor may add more than the allowed annual limit to their IRA, it is called a conversion and it works like a large lump sum addition. Conversions can only be made from traditional IRA’s to Roth’s and are executed by taking a chunk of money from your traditional IRA, paying the taxes that you would owe if you were to distribute the assets and add them to your Roth account without paying the 10% penalty. No such conversion privileges exist for Roth IRA’s they cannot be converted into any other type of retirement account.

An important thing to note here is that, when it comes to contributions to IRA’s, you are only able to add “earned income” to your account. Because these accounts are seen as a publicly available work retirement plan, the government stipulates that you have to have earned the money you’re adding to your IRA just like a job and a 401k. “Earned income” is basically what it sounds like, wages from a job, contracting fees, basically anything that you would pay income tax on. Things like pension payments, gifts, and dividends from investments do not qualify.

Now here is where the Roth IRA begins to really set itself apart from its traditional counterpart. In a traditional IRA, you are unable to add to your account once you turn 70 ½. While the government is happy to give you some tax benefits while the account is growing, they do still receive income tax on any money you withdraw from the account. They want you to draw your account down, so they can collect what’s theirs, and so they’ll prevent you from contributing and force you to withdraw once you turn 70 ½.

Roth IRA’s distributions, on the other hand, are never taxed, and therefore Uncle Sam really doesn’t care much when you access your account. Because of this, not only is there not a required distribution rule on Roth IRAs, you can also contribute (as long as its earned income) to your account at any age.

One of the important rules to keep in mind when contributing to your Roth IRA is that they do come with funding caps. Again, this tool is seen as a small investor stepping stool to a successful investing career. The federal government realizes how advantageous these accounts are to investors and therefore locks out higher-income individuals who don’t necessarily need the tax breaks.

If you are a single person who’s income reaches $122,000 the government starts to limit the amount of money you can contribute to your Roth IRA, If you earn more than $137,000 per year, you are totally locked out of contributing. For married couples who file their taxes jointly, the phase-out limit begins at $193,000, with total lockout occurring at the $203,000 income threshold.

Part 3: Managing Your Roth IRA

Intro to Investing

So, let’s assume that you have found a company who makes you feel comfortable and who has resources for someone of your experience level, and you have successfully funded your account. Congratulations on taking the first step, but now the real work begins. Once you add some cash into your Roth IRA, the institution you are working with will most likely be holding a “cash management” account in your Roth IRA.

Cash management accounts are highly liquid funds that hold government and corporate cash for the most part and are designed to behave essentially like bank cash with a very limited upside growth potential. If you’re interested in a Roth IRA, chances are you wanted to see some growth in the account. This means you’ll need to have some strategy to manage your Roth IRA, here’s where things get complicated. Millions, perhaps billions of words have been written on investing, so for the purposes of this guide we will keep it simple, but a vast library of resources exist for investors who would like to use more advanced strategies.

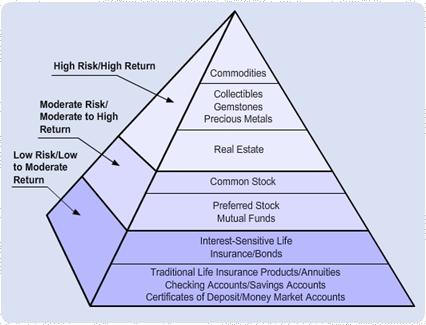

Risk vs. Reward

One of the first steps an investor must take, long before they purchase anything, is to determine their “risk tolerance”. Work with a financial professional to determine, based on your personality and current situation in life, how much risk you can tolerate. Everyone will be familiar with the idea of risk and reward, that the higher the potential rewards are, the greater the chances that you could lose everything. It’s critical to understand this before you watch your hard-earned money tanking in the stock market while you plan on using it in 6 months for retirement expenses.

Once you have an idea of your risk tolerance you can begin to explore certain types of investments that suit your goals and needs. Aggressive investors may want to buy individual stocks and take educated gambles, while more conservative investors will purchase investments more closely tied to bonds and income. For the purposes of this guide, we will stick to more tried and true methods of managing your Roth IRA.

Mutual Fund Basics

For many investors who want to open an IRA, their goal is long term growth of assets. One of the simplest ways to accomplish this is by using another revolutionary investment tool, the mutual fund. A mutual fund is simply a large basket of individual company stocks that are being managed and selected by a professional investment professional. These “funds” trade just like stocks with shares, but when an investor buys a share of a mutual fund, he or she is technically buying a tiny fraction of shares of every company that the fund is invested in.

This is called diversification and it goes just like the old saying. Don’t put all your eggs in one basket, the overall economy moves in unpredictable cycles, but when one sector of the economy begins to struggle, others usually do well, and vice versa. By owning a broad and diverse range of stocks and bonds, no matter the economic environment, some segment of your investments should be performing well enough to keep you on track.

Mutual funds are so powerful because they allow small-time investors to create the diversification that typical was impossible unless you had a large portfolio. Reason being, you cannot purchase a half of a share of stock. If a small-time investor wants to own a diverse portfolio of 100 stocks, they must buy 1 full share of each. With good companies like Google’s alphabet trading at over $1,000 for a single share, this would create a prohibitive cost for an investor with $500 to invest.

When you own one, or even a handful of companies, your portfolio is at the mercy of the news cycle. Company fraud, disruptive technology, or simple consumer preference could lead to an investor losing their shirt. Because mutual fund shares are arbitrarily created, a small investor can buy 3.64 shares of a technology fund, which holds 70 or 80 large companies in the tech sector. If one or two go bankrupt, that’s ok, you still hold 68 winners!

Thousands of mutual funds exist, and each of them has what is referred to as a “fund objective” when mutual funds are created, the companies organizing them create a directive for the fund manager to follow. You can find mutual funds that invest in specific sectors like gold mining, and you can find mutual funds that seek to broadly mirror the overall economy, the fund you choose, or group of funds, should be selected by carefully and should meet your risk tolerance and investing objectives.

Fee Structure Basics

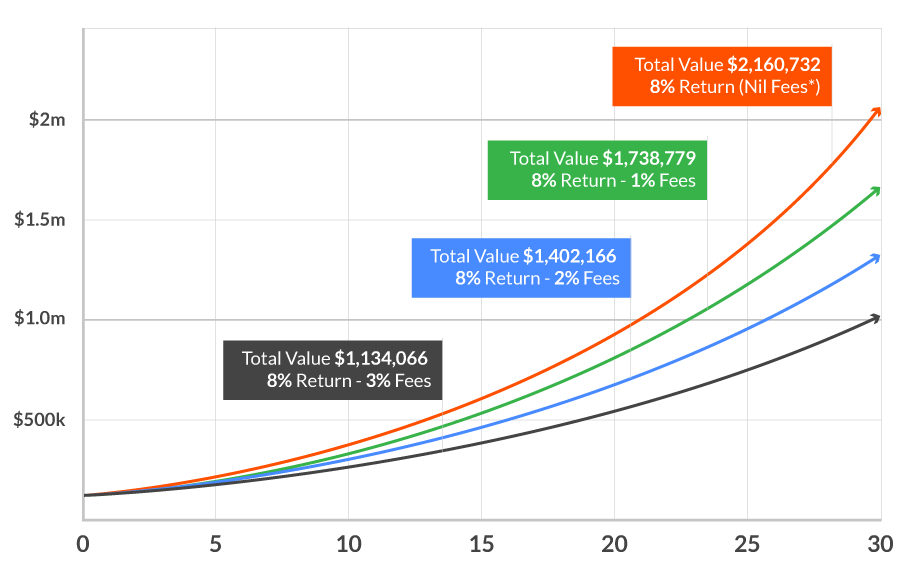

One of the other critical factors to examine before buying any investment are the fees associated with it. All investments carry fees and it is crucial to pay attention and make sure you have a crystal-clear idea of how fees are charged before buying in. Account A earns 5% interest per year and charges no fees, and investment B earns 5% per year with a 1% annual fee. If you were to invest $50,000 into each and run them out 20 years you would find that account A had grown to $126,347 while account B would be worth 104,384. With nearly $22,000 lost to fees over that time.

To further illustrate this point, the graph below projects the performance of several accounts with the same annual investment and growth rate, the only variable being changed is the fees being paid on the investments. While a 1% difference in fees may sound negligible, over a 30-year investing career it could cost you several hundred thousand dollars.

Fees are especially important where, on top of paying commission and sales charges, you are also assessed a management fee used to pay the funds advisor. Investigate all fees carefully and consider low-cost options, if you can recover 1% per year in fees from your account, have you not improved the performance by an entire percent?

Dollar-Cost Averaging

When it comes to funding your account, one of the final things to keep in mind is the unpredictability of financial markets. A mistake that many investors make is getting in when they are hearing good news about the stock market. These investors run the risk of purchasing a large block of investments during an upmarket, leaving them vulnerable if things turn around. One of the ways in which you can avoid making this mistake is also a great strategy for funding your account.

“Dollar-cost averaging” is the practice of purchasing a uniform dollar amount of investments on a periodic basis. Most people using this strategy will choose a round number like $200 per month and purchase their chosen set of mutual funds. Every month, month in and month out. This strategy has 2 advantages.

Firstly, because you are buying into your investments gradually, you can avoid the risk of trying to time the market with one big purchase. Secondly, and more importantly, buying the same dollar amount each month means you to buy more when shares are cheap, and less when they are expensive, buy low and sell high! When your chosen mutual fund is performing poorly and is undervalued, $200 will buy 5 shares. When that same fund is overvalued and is more expensive $200 may only buy 3 shares. By purchasing more when shares are down, and less when shares are up, you end up getting the most bang for your buck.

Putting the Roth IRA into Context

Now that we have covered funding and managing your account, we can discuss the placement of your Roth IRA in your financial picture. Common wisdom in investing says that, because there is no date at which you must withdraw money from your Roth IRA, this asset should be the last that you withdraw from. If you remember from above, the longer it will be until an investor needs to use the funds in their account, the more aggressive they can afford to be.

Because the Roth IRA can be held deep into your retirement, it is the account with the longest time horizon, more time means that investors can be more aggressive in their Roth IRA’s, and use funds from these accounts last. This strategy is only made stronger by the Roth IRA’s tax treatment. As we discussed before, funds that you add to your Roth IRA are taxed before being added to the account, and never taxed again. What this means is that any funds that you withdraw from your Roth IRA, they are not considered income.

This means that an investor gets to keep the difference between his purchase price and whatever the securities are on the day they sell them; he does not have to pay tax on gains. Holding investments longer only makes those potential gains greater. In summary, the Roth IRA is the account that you should focus on investing most aggressively in and for the longest span of time possible, using it as the high-risk growth center in your portfolio.

Part 4: Distributing Your Roth IRA

Accessing Your Roth IRA Assets

This brings us to the final stage of your Roth IRA’s lifecycle, distribution. In the way that there are rules investors must follow for funding and managing their IRA’s, there are rules that dictate how you can access funds in your account pre and post-retirement. You will also find, as in other sections, that your Roth IRA provides you with more flexibility and options than most other accounts.

Early Withdrawal Penalty

Since IRA’s are designated as retirement accounts, the rules set for accessing your money are designed to incentivize investors to leave the money in the account until retirement. In a traditional IRA, once money has been contributed to your account, there are only a few rare cases in which you can withdraw funds without paying the taxes that you owe on top of a 10% early withdrawal penalty.

A first-time home purchase, certain educational expenses, medical expenses, health insurance policy payments, distributions for active service members, or permanent disability, are the only exceptions that the IRS will make to the 10% penalty rule on early withdrawals. Aside from those events, an investor has the option to liquidate the account in equal payments for the remainder of their life or leave the funds in the account until they reach 59 ½.

These rules DO NOT apply to the Roth IRA as once again this investment tool provides increased flexibility for investors. When you invest money in a Roth IRA, you always have access to the amount of money that you contributed. That’s right, you can access your contributions to the account anytime, penalty-free. The only time you would pay a penalty in a Roth IRA is if you were to withdraw GAINS from your account before you reach age 59 ½.

In practice, this means that if an investor has contributed $20,000 to his account since he opened it, he has access to 20,000 penalty-free. If his account balance is $50,000, he would need to leave $30,000, the gain, in the account. The Roth IRA doesn’t stop there though. While most investors believe that gains in your Roth IRA must be left in the account until 59 ½, this is actually not the case. Once again the Roth IRA provides added flexibility by stipulating that gains must be left in the account for at least 5 years before they can be removed without incurring the 10% early withdrawal penalty.

Wrapping up the Roth IRA

This brings us to the end of this ultimate guide to the Roth IRA. Over the course of the guide, we covered how and where you can open your account, key things like fees to watch out for when selecting investments, strategies for funding, and ultimately strategies for distributing funds from your account. We discussed the rules and regulations that govern things like additions and withdrawals and even explored methods for funding your account to increase the chance of success.

Bear in mind that this guide is meant to be a crash course in the Roth IRA. There are many rules and regulations that we were not able to squeeze into this guide. Before moving any money you should speak with a financial professional to make sure that you are maximizing the benefits available to you. After going through the rough features of the Roth IRA, it should be clear that this account is a powerful wealth-building tool for investors looking to supercharge their portfolio. If everything goes according to plan, you could very well have a hefty and tax-free nest egg waiting for you and growing well into retirement.