What is a Traditional IRA?

A Traditional IRA is an investment account that falls into a larger category created by the federal government known as “retirement accounts”. Retirement accounts are exactly what they sound like, they are places you can put investments like stocks, bonds, and mutual funds and allow them to grow so that the account holder can build some long-term savings for themselves in retirement.

401(k)’s, deferred compensation, Traditional IRA’s and a few others are examples of retirement accounts that most people are familiar with. This guide will serve as a crash course in the Traditional IRA specifically but check out our other guides here.

Whether you’re a newbie to investing, or a soon-to-be retiree looking for a refresher before you leave work for good, you’ve come to the right place. Over the course of this guide we’ll be reviewing the Traditional IRA, one of the most commonly used investment tools in the United States. You’ll learn how they are used, what they do and how to best take advantage of them. We’ll also discuss some of the drawbacks to investing using a Traditional IRA.

We’ve broken this guide into sections, so feel free to navigate around based on what you’re looking for. For those of you who want a little more background on Traditional IRA’s, we might as well start from the beginning.

Table of Contents

- What is a Traditional IRA?

- History of the Traditional IRA

- How Does a Traditional IRA Work?

- Who is a Traditional IRA for?

- Getting started with a Traditional IRA

- Funding Your Account

- Tax Deferral

- Managing Your Traditional IRA

- Working with an Advisor

- Investment basics

- Risk and Reward

- Intro to Mutual Funds

- Intro to Fees

- Accessing Funds in Your Traditional IRA in Retirement

- RMD’s

History of the Traditional IRA

Financial life in America through the years was difficult. Most of what we all accept as the norm in terms of structure and security today really had to be ironed out over the years through simple trial and error. Banks, wire-houses, government regulation, even standardizing the types of accounts we use to invest took time. Investment of any kind in America required taking substantial risk in the early days. With little standardization and government oversight, as well as minimal safety nets in place for those who fell through the cracks, this spelled disaster for all too many retirees.

At some point around the turn of the last century, some corporations began to see the value in offering a work-based plan that would allow someone to ensure a certain level of income in retirement. In 1875 the American Express Company established the first modern pension as we know it today. Despite this early development, it was not until 1974 when the Federal government would begin to fully regulate and standardize work-sponsored savings plans.

In 1974, the ERISA act was signed into law (Employee Income Security Retirement Act) creating a standard for employers to follow. The government created several unique types of employer-sponsored savings accounts, specifically for retirement to be offered at work. These included 401(k), pensions, deferred compensation, and profit-sharing plans.

The Government created these accounts and added to them special tax incentives, then the government laid out certain criteria that an employer would need to meet in order to offer these new special accounts to employees. The whole purpose of the ERISA act was to create more protection and oversight for employees saving for retirement.

They would require your employer to do certain things like working with a qualified financial advisor when managing employee assets, as well as maintain certain records and gives employees the right to pursue legal action if they felt their assets were mismanaged.

This all sounds good for employees of companies large enough to offer these plans, but it didn’t mean anything for many Americans working part-time or starting small businesses. So, as part of the ERISA act, the government also created IRAs or “Independent Retirement Accounts”. These accounts would function like employer plans, with a few exceptions, but would be offered to all Americans regardless of occupation.

As long as you have earned income in some fashion, you could save it in one of these accounts. We say “accounts” plural because the government actually created 2 types of IRA, the Traditional as well as the Roth. We will be sticking to the Traditional IRA as we have already covered Roth IRAs in a previous guide (which you can find here).

How Does a Traditional IRA Work?

Traditional IRA’s function very much like your 401(k) at work, funds get added to your account on a tax-deferred basis. If you earn five thousand dollars that you decide to send to your Traditional IRA, you are not taxed on those dollars and everything gets invested. From there gains are allowed to accumulate tax-free until funds leave the account in retirement. At that point, you are taxed on any funds that leave the account at your current income tax rate. Think of it like putting away and investing your income to receive more of it at a later date. Money leaving your 401k or IRA is treated just like money that an employer pays you.

But why would someone want to put money in a Traditional IRA? Is it any better than a normal investment account at a bank? The answer has everything to do with taxes. Because the federal government wants to encourage individuals to save for retirement, they agree not to tax any money that is added to a traditional IRA, as well as any gain the account may experience. There are two catches to this. The first is that the money must stay in the account until the owner is at least 59½ years old. After all the funds are supposed to be used for retirement, and the second is that when funds leave the account, they all get taxed as current income.

Along with those stipulations, there are also limits on the amount that anyone can contribute in one year as well as set times when you have to begin taking money from the account. For Traditional IRAs, an individual may contribute $6,000 each year to their account. Individuals who are over 50 years old can contribute the $6,000 limit plus an additional $500 in “catch up” contributions in the year, bringing their limit to $6,500 annually. As for required distributions or RMD’s, they begin at age 70½ and essentially require anyone with one of these accounts to withdraw a minimum amount, determined by a set formula. The government was nice to you while you were accumulating, but they want their tax money, and so they’ll penalize anyone who fails to withdraw this minimum amount by FIFTY percent.

Who is a Traditional IRA for?

So, who should consider using an IRA? Is there any one group that it is best for? In short, traditional IRAs are for everyone. They’re designed to be used as an independent savings vehicle for American families. Those of us who are not fortunate enough to have a solid employer-sponsored plan can turn to an IRA to provide us with the tax incentivized retirement savings. Ideally, everyone should have one of these accounts. For the most part, traditional IRAs are used by investors of all ages who make enough income to set aside a portion of it.

Typically, higher-income earners take advantage of the traditional IRA as it provides an income deduction in this year, and higher earners are “locked out” of contributing to Roth IRA accounts. Setting up and IRA is easy and can be done in a number of different ways.

One thing to keep in mind for new investors looking to set up one of these accounts is the accessibility of the funds. Generally, it is unwise to begin saving directly into one of these retirement accounts. While the tax incentives are nice, the money becomes very costly and difficult to access as soon as it makes its way into the account. Young investors frequently dive headfirst into retirement investing before having proper savings in places like cash in bank accounts or non-retirement investing accounts where you can access money at any time.

All too often, when people inevitably encounter financial challenges and realize all of their saving has been done in places where accessing funds early will trigger a penalty. If you are just getting started, consider working on cash savings or standard investment accounts until you are satisfied that any money you send to your IRA will definitely not be needed until retirement.

Getting started with a Traditional IRA

Assuming that you have proper savings set aside elsewhere and would like to begin investing for retirement, you’ll need to select a firm or company to open your account with. This can be taken care of at your local bank, your local financial advisor, or at a financial firm like Fidelity or Vanguard. Keep in mind that where you open your IRA could potentially have an impact on the things that you’ll be investing in once you add funds to the account.

Look for flexible investment options and try to avoid small community banks who could have your money in one of the bank’s lower-performing products where you could be invested in the US economy elsewhere. Work alongside a financial professional, even if it’s just a support person over the phone to get a clear understanding of how your money will be invested once funds hit the account.

Funding Your Account

There are essentially 2 important decisions that you will need to make once your account has been opened. How much would you like to put in? And, how would you like that money to be managed, or invested? The first of these decisions is rather easy. Unlike many other types of investment accounts where the owner must write a check or authorize a wire transfer to get funds in, many companies who offer Traditional IRAs allow for automatic bank drafts on a set schedule.

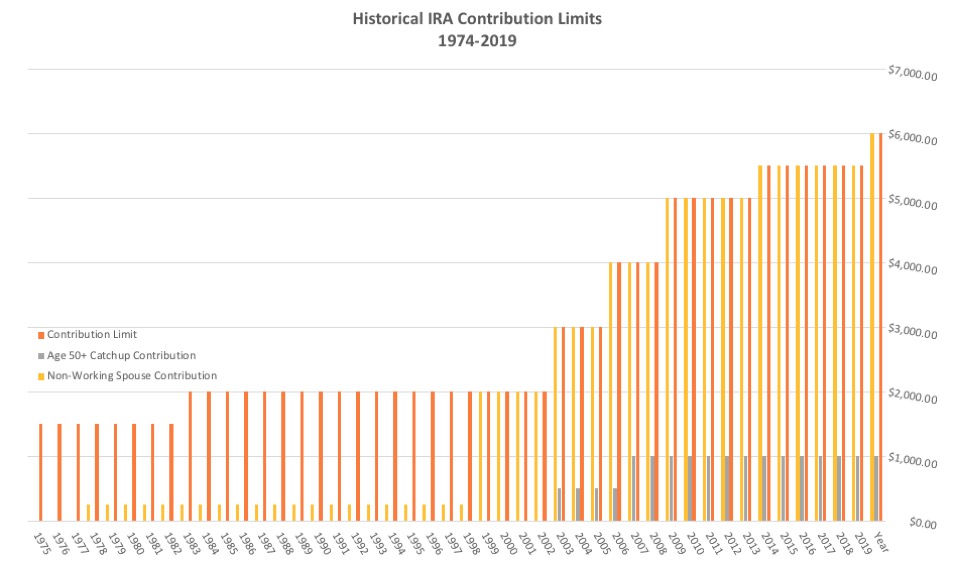

Allowing investors to automate their saving into these accounts. Be mindful of annual caps, as they change frequently, and overfunding your account can also lead to penalties. Below you can find a chart showing historical limits on contributions, as you can see there is a steady trend towards more savings over time.

Tax Deferral

So, let’s dive further into this idea of tax deferral. What’s so great about it? Let’s say a new investor creates their own Traditional IRA. If they are earning $50,000 each year and do not have access to a 401(k) then the only tax deferral available to them is the Traditional IRA! They send $5,000 into this account throughout the year, and at year-end can show $45,000 as their income on next year’s taxes. Whatever they decide to defer to their Traditional IRA is not counted as income and is therefore not taxed.

This is beneficial as your tax bracket can influence other things like your capital gains tax rate and is used when calculating many benefits. Although this side of tax deferral is nice, there is another, even more beneficial use for the tax-deferred nature of these accounts.

Like all retirement accounts, the Traditional IRA allows funds inside to appreciate without tax until withdrawal. What this means for investors is that the value of the account can compound faster and faster as $20 saved in taxes grows to $40 and then $60. To illustrate this point we will use an example.

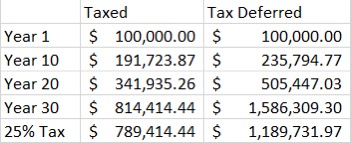

The “taxed” column represents a normal taxed account, each year as the investments produce income and dividends, those cash flows are taxed chipping away at the growth potential. In the “tax-deferred” column we see a retirement account where gains in the account are left to compound until they are taxed at withdrawal.

In the “taxed” column, you are seeing a 10% annual rate of return, after each year a 25% tax is assessed on gains in the account. In the final row, we remove $25,000 to tax our original $100,000 balance at 25% as well and we are left with nearly $800,000. This isn’t too bad, but it starts to seem a little underwhelming when compared to the nearly 1.2 million that tax deferral allowed you to accumulate over that same span of time.

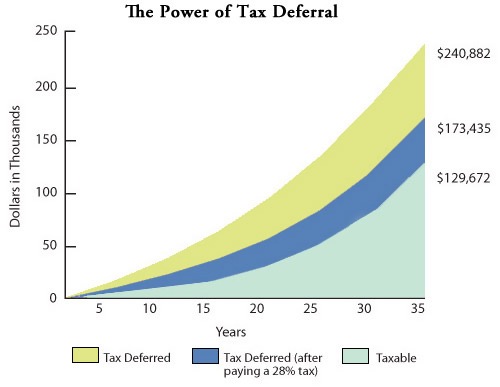

Here’s a visual example of the same concept. The trick here is compounding. Warren Buffet said that man’s greatest invention was compound interest and here’s why. Just by leaving in an extra 25% of the gain, the tax-deferred account sees much faster growth as next year’s rate of return is based on the accumulated gains in the account each year. Although you still need to pay 25% in the end, the increased earning power on the way up pays.

Managing Your Traditional IRA

So, if you are sold on the benefits of tax deferral and have a certain level of savings, you are on to the fun part. Investing! At this stage, you’ll need to look into managing the account. In finance, managing your account refers to selecting investments, watching carefully as the things inside increase or decrease in value, evaluating fees, and rebalancing when needed. This may seem like a daunting task but there are many resources at your disposal if you’re willing to do a little extra work. On top of this retirement accounts, by nature, are designed for long term investing.

Because your funds will have many years to accumulate, less can be more when it comes to managing your account. Selecting solid long-term funds that will provide steady returns over time will get you just as far as attempting to time the market and actively invest in your account. Many investors may actually see better long-term performance buying and holding than constantly turning over investments inside the portfolio.

Working with an Advisor

It’s important to note that no matter where you work, your Traditional IRA is “managed” by a third party. Companies like Fidelity, Vanguard, Cetera, and many other financial services firms offer service to these accounts. Pairing with one of these larger firms will typically allow for the lowest fees, and for certain asset levels will even get you free access to a financial advisor.

What this means is that, if you’re Traditional IRA is managed by Fidelity, you will have access to a fidelity advisor as well as their tools to help you with any questions you may have. You will have access to an online platform where you can view your investments and make changes as well as ask questions. When getting started this is usually a good place to begin.

As mentioned above, the company that you decided to work with when creating your IRA can have an impact on the investments, they advise you to purchase in your account. For the most part, this is not true, but when working with small banks or credit unions who only sell cash-based products, you can find yourself in a very low yield, high fee environment when this is simply not necessary.

Sticking with a larger company will ensure that they have the ability to sell you anything you would like from an investment standpoint. In order to better equip you for this investing conversation, let’s take a look at the basics of investing.

Investment basics

When you first add funds to your Traditional IRA, they will be held in what as known as a “money market fund”. These funds are linked to cash-backed securities and are not designed for growth but rather simply to hold their value over time. They are very low risk, and for that reason offer very low potential for return. If you’d like to see your money start growing, you’ll need to begin purchasing more aggressive investments such as stocks and bonds.

The type of investments you select has to do with many factors like your level of experience, the amount of risk you are comfortable with as well as your time horizon. Time horizon refers to the length of time that an investor has until he plans to use the funds from his investment.

Generally, a longer time horizon usually means that an investor can take more risk. If you plan to use the funds you are investing within a few months, it probably isn’t a good idea to buy something that is highly volatile as you may find that they have lost a large portion of their value when you go to access them. Alternatively, someone who won’t need the funds for several decades has plenty of time to recoup losses and can afford to be a little riskier.

Risk and Reward

Understanding the balance between risk and reward is essential to investing success. The higher your chances of making lots of money on an investment, the greater chance there is that you could also lose the money. Think high risk, high reward, low risk, low reward. This makes sense, markets reward individuals who take long-shot bets and risk their investment. Think of a bet with a friend, if two sports teams are set to play against one another, and one of the teams is clearly the best in the league, then placing a bet on them to win is safe!

Everyone else can also see how lopsided the game is going to be and so they jump in too, before you know it there are millions of people with the same bet, and so any winnings are divided amongst lots of people. The worse team would have “longer odds”. People placing bets on them would enjoy high rewards if, on the off chance, they won. This was a risky position to take and it was only taken by a few people. Meaning the big pot is split between a handful of people.

It is important before you begin investing, to identify your “risk tolerance”. This is the degree to which your personality and circumstances allow you to take risk. A soon to be retiree who prefers to be safe will invest very differently from a recent grad who loves to take risks. It’s impossible to start selecting investments until you identify where you are on that scale.

When it comes to selecting these investments, one of the concerns that many investors have is that they’ll pick the wrong investments. Selecting individual stocks and bonds can be a daunting task and requires lots of understanding and research. So, where do investors go who are simply looking to set it and forget it? If you just want to add money to an account on a monthly basis and not worry about watching the investments inside, mutual funds may be the way to go. Let’s dive into these powerful investing tools!

Intro to Mutual Funds

For investors who want to get in on the stock market but who don’t necessarily want the headache of managing their portfolios, mutual funds really are the answer. A mutual fund is essentially a pre-packaged portfolio of stocks, selected by a professional according to a fund’s objective. For example, a large financial company can decide that it would like to create a “Technology growth fund”.

The company will find a manager with experience investing in this sector and will dedicate a pool of money to him or her. Once this manager has their pool of capital, they construct a portfolio of stocks within the technology industry, which meet the funds stated objective of providing solid growth opportunities.

Once this large portfolio of stocks has been created, the company will begin to sell shares of its new mutual fund. Investors can purchase any dollar amount they would like, and in return, they’ll receive proportional interest in all of the companies that are held within the fund. This means that with $100 dollars, an investor could buy tiny positions in 50 different companies simply by owning the mutual fund. Rather than pick one or two stocks to buy, they can have exposure to an entire industry.

Mutual funds are so powerful because they allow small-time investors to create the diversification that typically was impossible unless you have a large portfolio. The reason being, you cannot purchase a half of a share of stock. If a small-time investor wants to own a diverse portfolio of 100 stocks, they must buy 1 full share of each. With good companies like Google’s alphabet trading at over $1,000 for a single share, this would create a prohibitive cost for an investor with $500 to invest.

When it comes to selecting which funds are right for you, it may be time to consult with a financial professional. There are thousands of these mutual funds, and each of them has what is referred to as a “fund objective” when mutual funds are created, the companies organizing them create a very specific directive for the fund manager to follow. You can find mutual funds that invest in specific sectors like gold mining, and you can find mutual funds that seek to broadly mirror the overall economy, the fund you choose, or group of funds, should be selected by carefully and should meet your risk tolerance and investing objectives.

Intro to Fees

Before you run out the door and begin looking for funds to buy, be warned that there is always a tradeoff in investing. If you like some of the highly technical investing strategies with complicated objectives, you may have to pay for that at a higher annual fee. On the other hand, some funds are managed by a computer and have very simple objectives making them incredibly inexpensive.

The iShares S&P 500 fund for example simply holds each of the 500 largest companies in the US. When one company is replaced by another on the list, the computer simply replaces the investment position accordingly. So how do you know which funds are cheap and which ones aren’t?

One way to find out is to look at the fund’s prospectus. This is a small book that details every square inch of the fund. This document will explain who manages the fund, what the rules are for the manager, the expenses of the fund and the historical performance as well as much more. Another quicker way to find this information is to look at the funds “fact sheet” available online.

These documents will give you an idea of the all-important “expense ratio”. The expense ratio is the percentage of the fund’s assets that are liquidated annually to pay for the fund’s manager, the salespeople who sell the funds, and the marketing teams who put together brochures and materials.

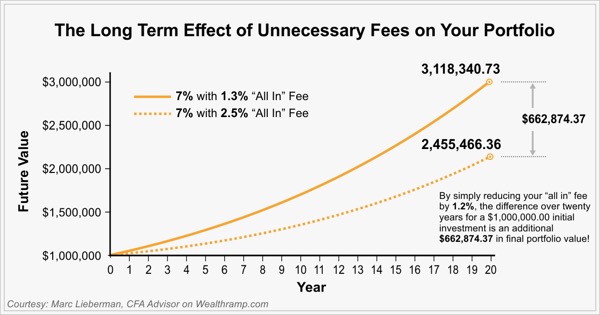

As a general rule, most funds have an expense ratio somewhere between 0.5% and 1.5%. There are funds that are higher and lower, but this is a general range. It is very important to understand the expense ratio before investing because this percentage is removed every year from the value of the fund. That means that each and every year, a percentage of your entire account value will be turned into cash and pulled out of the fund to pay everyone. The impact that liquidated one percent of your account every year can be massive over time. We’ll discuss this more below.

On top of the annual expense ratio, another fee that you will have to contend with is the up-front sales charge. When you buy a fund for the first time, a small percentage of the money that you set aside is used to pay the salesperson a commission. These fees range from zero all the way to five percent plus! This means that someone adding $100 to their account each month, will actually be adding $95 to their account and paying a $5 commission. All of these fees can be identified and explained for each fund and before buying anything you should have a solid understanding of them and how they will impact your account.

Accessing Funds in Your Traditional IRA in Retirement

We’ve covered some of the rules regarding your Traditional IRA, we’ve discussed opening your account, as well as managing it, now its time for the part that everyone has been waiting for. Accessing your money! For many, their road to retirement is riddled with bumps and setbacks, and occasionally it can be difficult to make ends meet. Unfortunately, your Traditional IRA is designed for retirement.

Anyone who is looking to withdraw funds from there account before they reach retirement age (59 ½) they will have a 10% penalty assessed on any withdrawals from the account ON TOP OF the taxes that are owed upon withdrawal.

Rules for withdrawal pre-59 ½

There are few qualifying exceptions such as first-time home purchase, qualified educational expenses, or medical bills, but for the most part, accessing any Traditional IRA assets pre 59 ½ will trigger a penalty. Ask your HR department if you qualify for an exemption or work with a financial professional to determine if a withdrawal is in your best interest.

Rules for withdrawal post 59 ½

That aside, for those who have successfully made it to retirement, the Traditional IRA is very straight forward. Once you have reached 59 ½, you may access the account at your discretion. One thing to keep in mind is that you are responsible for paying income tax on anything that you withdraw from the account (remember we deferred those taxes). This means that if $100,000 is pulled out of your account at once for a home purchase, you will need to cut a check to Uncle Sam for a certain % of that depending on your income level.

RMD’s

One other thing to keep in mind is the required minimum distribution requirements. The Traditional IRA, like other retirement accounts, carry a distribution requirement. This means that, if there are still funds in the account in the year that you turn 70, you must begin to take mandatory minimums out of your account each year. The government was nice to you all these years letting the funds grow tax-deferred, but now they want their share.

In the calendar year that you turn 70 ½, you must withdraw a set amount of money from your accounts. Those who fail to do so will pay a 50% penalty to the IRS in that year, ouch!

To tie all of this together, the Traditional IRA is a retirement account much like the more traditional 401(k). It is a place where investors saving for their retirement can hold investments in order to defer taxes on them. When used properly it should be a place where members of any and every American can build and grow a nest egg for retirement.

When used as intended this powerful tool can allow you to set aside and invest enough to allow for an early retirement filled with more of the things that you want to do.

If you’d like more information on the Traditional IRA, contact your financial professional, it’s always important to seek out professional guidance before making any big money decisions.