What Is A 401(k)?

So, you paid attention in class, you passed all your tests, and you’ve finally nabbed that diploma. All those years of hard work have paid off, and you get ready to walk into the building on your first day of work. You sit down at your desk, and the first thing your HR department hands you is a thick stack of “benefits election” forms.

Nothing in your education has prepared you for this moment, where do you go from here? Lucky for you, there are guides on the internet for things like this, and you found one! While we won’t be looking comprehensively through the list of potential benefits you receive at work, we will cover one of the employee benefit staples of working in America: the 401k.

A 401(k) is essentially an account, like the one at your bank, that can hold not only cash but its main focus of investments. As you work and defer money from your paycheck into your 401(k) account, the funds you set aside are used to either purchase investments or be held in cash.

In this guide, we will discuss the 401(k), who qualifies for one, understanding the investments in it, and what to do when it’s time to set off into retirement.

Table of Contents

Retirement Accounts 101

Before we discuss rules and regulations, let’s first look at what a 401(k) is and how they came to be. Your 401(k) is what’s known as a “retirement account.” If you’ve read any of our other ultimate guides, you know that a retirement account is essentially just a place you can put investments like stocks, bonds, mutual funds, or even plain cash, and allow them to grow so that you can create some long-term savings for you to live off of when your income stops at retirement.

401(k)’s, IRA’s, deferred compensation, 403(b)’s and a few others are examples of these “retirement accounts.” They differ from your average investment account because they have been created and standardized specifically by the federal government to help encourage people to take advantage of saving for their retirement.

Getting Started with your 401(k)

While 401(k) refers to a section of the US tax code and therefore is established by the US government, these plans are offered through employers to their employees. When a company is created, its owner has a range of benefits he or she may or may not decide to offer.

A 401(k) is a relatively inexpensive option and is widely sought after, making these plans very common among larger companies. If you are an employee of one of these companies, you are entitled to participate in their 401(k) once you meet the company set qualifications.

As we delve into 401(k) plans and how they work, one important thing to keep in mind is the individual nature of these plans. While many of the rules and regulations surrounding them are determined by the government, many aspects of your companies, 401(k) are set by your employer.

Your employer can determine many important features of your plan, and therefore it’s important to communicate with your HR department about specific details of your plan before taking any decisive action.

Who Qualifies for a 401(k)?

Even if your employer is one of those who offers a 401(k) plan to their employees, you may not be able to add to it, yet. Typically, there will be a requirement of 6, 12, or 18 months of work with your firm before they will consider you to be eligible to start your 401(k). Whether or not there is a requirement like this at your company is totally up to the owners, and your HR department will be able to provide you with an in-depth description of your benefits.

Again, many of the features of 401(k)’s that we discuss in this guide are ultimately decided upon by the company that chooses to offer the plan.

How a 401(k) Works

Now that we understand the basics of what a 401(k) is, and who can add to them, we can learn more about how they are used and what they can do. Before you start investing, you’ll have to add some money into the account. As stated above, contributions to your 401(k) are made from your paychecks at work.

When you become eligible to contribute to a companies 401(k) plan, you will be given forms to complete to set your contributions to the account. You have the choice at this point between setting aside a specific dollar amount from each paycheck, or a percentage of each paycheck. Many people elect to set aside a percentage of salary, typically ranging between 5% and 15% of salary. Once you determine the amount you would like to “defer” you will be up and running.

An important thing to note here is the word “defer.” When funds are added to your 401(k), they are done so on a pre-tax basis. This means that if you are earning a salary of $50,000 each year, but you contribute $6,000 to the account, you will pay taxes on $44,000 of earnings.

That’s right! Any money that you add to your account will not be taxed and will not show up on your taxes in that year. Don’t get too excited; you’ll have to pay taxes on that money when you withdraw in the future, just not today.

This feature of 401(k)’s is attractive to high earners and those looking to minimize tax while they’re working. There is a limit to the amount of money you can contribute and therefore write off, however. Limits on 401(k) contributions state that in any one year, employees can choose to defer up to $19,000 of their salaries into their 401(k).

Employees who are 50 years old and up can contribute to the $19,000 limit plus an additional $6,000 in “catch up” contributions bringing their limit to $25,000 annually.

Matching Contributions

This is where 401(k) plans get very interesting. Aside from any contributions that you may make to your account, you may have an opportunity to take advantage of what is called “employer contributions.” Whether or not your 401(k) plan offers employer contributions depends entirely on decisions your employer made when they created the plan.

When a 401(k) plan is established, the owners of the business have an opportunity to provide “matching” contributions to their employees.

Matching contributions are just what they sound like. These are funds contributed by your company to your account based on your contributions to the account. Some firms offer straight matches, or one for one match, up to a set percentage of salary.

Joe, for example, who works at a manufacturing plant earns $75,000 each year. His employer has set a matching contribution of “up to 6% of salary”. This means that his employer will match any dollar that Joe adds, up to $4,500.

As we discussed above, an employee typically sets aside a stated percentage of income. This means that Joe may be contributing 10% of his income to his 401(k) but is only being matched on 6%. On the other side of this coin, if Joe is not contributing, his company contributes nothing as well. While this example is meant to be simple, this represents a generous offering based on the matches available in today’s marketplace.

Most employers offer a 50% match up to a percentage of salary. A common matching program may sound something like “a match of 50% up to 5% of salary”. This means that for every dollar that Joe contributes, up to 5% of his salary, his company will contribute fifty cents.

While understanding your companies match, may seem confusing, it is important to understand as these programs can be very lucrative if taken advantage of early. Matching contributions set 401(k)’s apart from most other investment accounts as just another feature allowing for long term saving success.

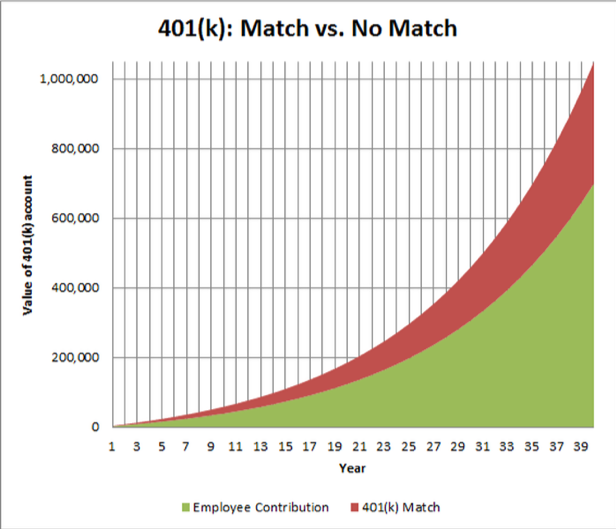

As you can see from the image above, the impact of an employee match on the total value of your account when you finally reach retirement can be massive. The chart above illustrates an important point and highlights one of the powers of the 401(k). Time is your best friend in these accounts, a contribution that represents just a sliver of total contributions in the early years is quickly able to compound itself, representing a much larger piece of your future 401(k) nest egg.

Tax Deferral

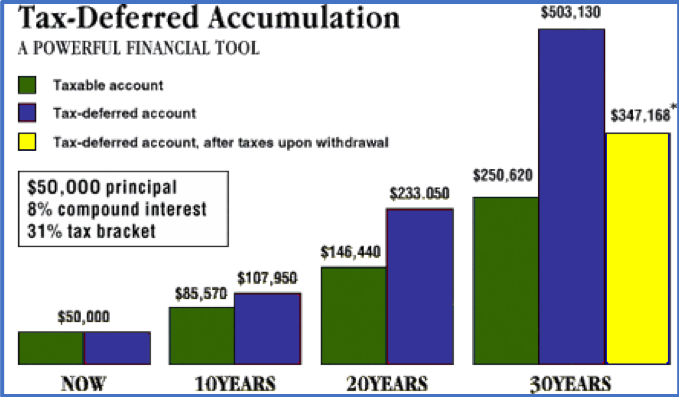

Finally, when it comes to knowing how a 401(k) works, you must understand one of its most significant benefits, tax deferral. Like most all retirement accounts, the 401(k) allows funds inside to appreciate without tax until withdrawal. What this means for investors is that the account’s value can grow more quickly as $20 saved in taxes grows to $40 and then $60 in future years.

We say that the taxes are “deferred” because they are not avoided, simply moved into the future. Allowing taxes to be paid later, however, allows the money in the account is to grow more quickly.

This occurs because each year as the normal accounts see their investments produce income and dividends, those cash flows are taxed, chipping away at the overall growth potential of the portfolio. This leads to two steps forward, one step backward as far as gains go. In retirement accounts, however, the owner can avoid all those backward steps and take advantage of compounding returns on their saved tax dollars.

Here’s a visual example of the same concept. The trick here is compounding. And as you can see, allowing the taxes to stay in the account until withdrawal leaves you much better off, even after paying your taxes on the back end.

Albert Einstein is known to have coined this phrase, “Compound interest is the eighth wonder of the world, he who understands it earns it; he who doesn’t, pays it.”

Here’s how that works, just by leaving in an extra 25% of the gain, the tax-deferred account sees much faster growth as next year’s rate of return is based on the accumulated gains in the account each year. Although you still need to pay 25% in the end, the increased earning power on the way up pays.

Managing Your 401(k)

Assuming you are eligible for a 401(k), have determined how much you’ll be deferring, and have contributed to the account, it’s time to manage your quickly growing nest egg. This is where your investing journey begins.

An important feature of these plans to understand is the limited investment options that you will have inside of them. This is another area in which your employer will be making the decisions.

When a 401(k) plan is established, your employer works with a financial services company to get everything set up. Once the plan is up and running, this outside company, known as the “plan administrator” is responsible for helping to manage and monitor the plan.

At the time that the plan is created, the plan administrator works alongside your employer to help them select the investment options that will be offered within your specific 401(k). These options vary greatly from company to company, and a complete list of your plan’s investment options should be easily available online or with your HR department.

While you technically can hold all your 401(k) savings in cash, most people will decide to invest their savings more aggressively. Because you won’t need to use this money for a long time, hopefully, you can take some long-term bets and be a little aggressive when you’re getting started. This is where management comes in. In finance, management refers to selecting investments, observing as they increase or decrease in value, evaluating fees, and rebalancing when needed.

When done correctly, your 401(k) management should take a more passive approach. Since you have a limited number of investments to choose from, timing the market and switching between investments in the short-term is pointless. Your job is to select several well-diversified funds according to your risk tolerance and retirement date and to hold them for the long-term.

Investment Basics

To help you do that we will dive here into a brief look at the basics of investing, one thing to keep in mind is that investing is complicated and should always be done carefully. Seek out help if you feel overwhelmed and always be willing to learn more!

At the time that you determine your contributions to the account, you’ll also be able to decide how your contributions are allocated. You will be able to determine which funds each dollar goes. The type of investments you select will be largely determined by factors such as the amount of risk you are comfortable with, time until retirement or how soon you’ll need the money, and the current stock market environment.

Generally, a longer time horizon usually means that an investor can take on greater risk. If you plan to use the funds you are investing within a few months, it probably isn’t a good idea to buy something that is highly volatile as you may find that they have lost a large portion of their value when you go to access them. Alternatively, someone who won’t need the funds for several decades has plenty of time to recoup losses and can afford to be a little riskier with their investment options.

Mutual Fund Basics

A quick look at your statement, or your investment options, will show you that typical stocks and bonds are not what you will be investing in within your 401(k). What you’ll see instead are “funds.” A fund is simply a whole portfolio of investments which an investor can buy into and out of.

Each fund will carry it’s own “fund objective” that determines what belongs in the fund and what doesn’t. Funds are typically run by an investment manager whose job it is to ensure that the fund is managed well and within its objective. Each fund available to choose from will hold anywhere from fifty to hundreds of individual company’s stocks.

Below are a few examples of funds as well as their objectives:

“The XYZ Technology Sector Growth Fund seeks to identify and invest in the fastest-growing companies in the technology sector.”

Or

“The XYZ Safe and Slow Value Fund seeks to achieve steady and safe capital appreciation over time.”

Based on the goal of the fund, the asset manager will have to stick with that strategy and manage it over time. These funds are useful because they allow investors to select broad categories, or sectors and leave the complex individual investment selection to professional managers.

This prevents investors from putting their nest eggs behind one or two companies who could fail, bankrupting the investor. As the old saying goes, don’t put all your eggs in one basket!

By creating funds, companies can allow small investors to seek returns like stocks, but without the cost that would come with individual diversification. For example, if an investor likes technology companies, he or she can choose to buy stock in Facebook or the fund above, which invests in multiple technology firms. Let’s say that bad news breaks about Facebook, the investor who holds the company stock will be in for a wild ride as the price of his investments reacts to the bad news.

An investor who owns a technology fund, however, can rest easy, their fund owns Facebook, but it also owns 75 other technology companies. The main takeaway here being, when an investor buys shares of a mutual fund, he or she is technically purchasing a portfolio of companies hand-picked by a professional that is managed over time.

Risk and Reward

As you begin to explore the funds available to you, it is important to start to understand the fundamental relationship that exists in investing between risk and reward. The higher your chances of making lots of money on an investment, the greater chance there is that you could also lose the money. Think of it this way: high risk, high reward, low risk, low reward. This makes sense; markets reward individuals who take long-shot bets and risk their investment.

Every investor will fall somewhere on the continuum between very aggressive and very conservative when it comes to risk. It is very important before you begin investing, to figure out where you fall.

This measure is known as an investor’s “risk tolerance.” This is the degree to which your personality and circumstances allow you to take risks. This will be one of the most important variables in determining which funds you select within your 401(k) plan. Speak with your plan advisor if you have any questions about the funds available to you and how they are managed.

The Three Fees

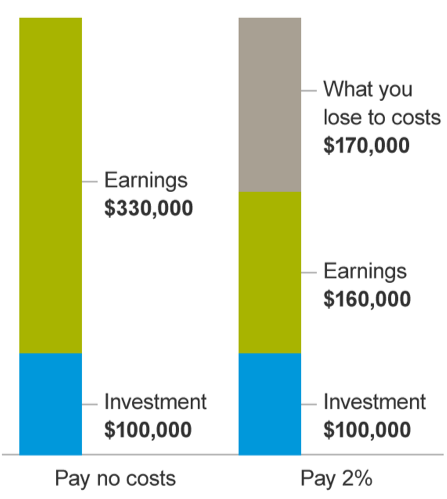

Another important variable in selecting your investment. While your 401(k) will come with a handful of administrative fees right out of the box, the investments that you choose will also carry fees. The impact that fees can have on a portfolio over time cannot be understated.

As you can see from the example above, paying an extra 2% in fees over a 25-year study period results in $170,000 in lost earnings! So, before you dive headfirst into selecting funds, make sure to examine the fees.

When it comes to mutual funds, there are three fees that you experience as the client. First, you pay the upfront sales charge. To “buy-in” to a mutual fund, these companies, and the salesperson who assist you charge an upfront commission for their services. This usually ranges from 3-6% of your initial purchase and, typically, can be waived in a retirement account.

The second type of fee is a “12b-1” fee. “12b-1” refers to the section of the SEC rules that govern fees charged for marketing and distribution. 12b-1 fees mainly pay for marketing inclusive of distributing sales materials for the fund. Management fees are more straightforward and usually compensate the people who are choosing the investments inside of your fund.

The third type of fee is a management fee. Management fees typically are the largest of the fees and the one that varies most from fund to fund. A fund that invests in complicated options trading strategies may require much more work than a passive fund managed by a computer and therefore may result in a higher management fee.

The total amount of annual fees a fund pays in a year as a percentage of its total assets is known as the “expense ratio.” Expense ratios are important to understand before jumping into any investment because they will be charged each year on your account. As we’ve discussed, the impact of even a marginal fee can result in a significant loss on your nest egg potential.

Management fees are imperative to understand because while the up-front charge is assessed only on new money going in, the 12b-1 fee as well as the management fee is calculated annually and assessed on the entire value of your account. A mutual fund that holds $1,000,000 in securities with an expense ratio of 1% pulls $10,000 (1% of 1,000,000) in cash each year that ultimately comes out of the investor’s pocket.

A typical management fee may fall anywhere between 0.2% per year and 2% per year for the most expensive funds. The good news is, you will have all this information in advance of selecting your funds.

When it comes to 401(k) investing, the lack of options means you are probably going to be buying and holding these funds for many years. With a long time horizon, you don’t need to be highly technical to see a large return. Eliminating an unneeded half of a percent in fees may add tens of thousands of dollars to your net worth in the long run.

But if a fund has a higher historical yield with a higher fee, it may be a wise financial choice to invest in the fund if it has an exemplary track record. With all of this said, weigh the funds available and their fees accordingly, when needed, ask a professional for clarification.

Accessing Funds in Your 401(k)

After getting a better understanding of how to open your account, funding it, as well as managing it, it’s time to discuss using the money! Like all other stages of the 401(k)’s life cycle, there are certain rules and regulations regarding how you can use the funds within the account.

Accessing your money will be simple enough, but based on your age and employment status, you may be faced with many difficult decisions.

One of the most important things to be cognizant of is that your 401(k) is essentially a pool of stored income. Remember that you have not paid taxes on any of these dollars yet. When any distribution is taken from a 401(k), it will trigger an income tax event. Unlike other investment accounts, where you pay a capital gains rate, with a 401(k) you pay your income tax rate on all money taken from the account.

Part of the reason the government would like to have you keep funds in the account has to do with what they stand to gain. They are entitled to tax on every dollar in your account, both your contributions and gains, the longer you invest those contributions and gains, the more money there is for Uncle Sam to tax as income.

That may be a frustrating fact but at least income tax is all that you will pay, assuming you have reached retirement age, and are no longer working with the company who you had your 401(k) with.

But what about those who have not reached their retirement age yet? For many, their road to retirement is riddled with bumps and setbacks, and occasionally it can be challenging to make ends meet. Unfortunately, the 401(k) is designed for retirement.

Anyone who is looking to withdraw funds from their account before reaching retirement age (59 ½ years old) will have a 10% penalty assessed on any withdrawals from the account in addition to the taxes that are owed upon withdrawal.

401k Loans and Withdrawals

One way around this penalty is to take a loan from your 401(k) balance. This is a bit complex because technically the money isn’t yours yet. You read that right, even though it is money from your checks, the funds within the plan technically belong to the plan, and not the owner.

Things get a little tricky here, but it’s important to understand that this loan will have to be paid back, with interest, and should only be considered in emergencies. Any outstanding loan balance or interest remaining at retirement will be netted out of the total account value when the funds are moved out of the plan.

For individuals who have experienced certain hardships, some rules allow for an individual to remove funds from their 401(k). Once again whether or not you can make a withdrawal will depend on your specific plan. If your plan does allow for hardship withdrawals, you will likely be eligible if you have experienced one of the following:

- Unexpected medical expenses

- Costs relating to the purchase of a home

- Tuition and related educational fees and expenses

- Payments necessary to prevent eviction from, or foreclosure on, your home

- Burial or funeral expenses

- Expenses for the repair of damage to your home

Unfortunately, a hardship withdrawal will not prevent the IRS from collecting their 10% penalty, it will simply allow you to withdraw funds from your plan while you are working. This is typically not allowed unless you loan the money from your company, while you are still employed.

If you are older than 59½ and you are still employed by the company, you do have the option in some plans to take what is called an in-service withdrawal without paying any penalty.

401k Required Minimum Distributions

A frustrating reality for many retirees is known as required minimum distributions, also known as RMDs. A 401(k), traditional IRA, and most other retirement accounts carry a distribution requirement. This means that, if there are still funds in the account in the year that you turn 70 and a half, you must begin to take mandatory minimums out of your account each year.

The government was nice to you all these years letting the funds grow tax-deferred, but now they want to commence collecting those precious taxes they allowed you to defer for all those years. The actual dollar amount that you need to take is calculated by the IRS according to a formula that forces more and more money out of the account the older you get.

These forced withdrawals may have a negative impact as they will increase taxable income and force investors to write checks out of the funds to pay the government. Keep in mind that for many elderly investors, annual income determines things like cost of Medicare premiums, social security taxes, and many other items. Having the government force you to report more income can be a real nuisance in retirement.

Conclusion

Now that we have taken a look at your 401(k) from day one on the job to retirement, it’s time to start researching your specific plan and getting started. As stated in the guide, there are dedicated professionals whose job it is to help you out when it comes to investing for retirement that your company can provide you with.

When it comes to investing, it’s always a good idea to get professional guidance, so get in touch with a 401(k) specialist if you have questions. Your 401(k) is your golden ticket to retirement and should be valued as such.

When used properly, it should be a place where investors confidently grow a future income stream that will carry them through a long retirement full of the things you find important. If you’d like more information on the 401(k) contact your financial professional.

You May Also Like: The Ultimate Guide To The Roth IRA